Common Questions About the EB5 Visa Answered

Wiki Article

Opening Opportunities: The Complete Guide to EB5 Visa for UK Citizens

The EB5 visa program offers a path for UK people seeking irreversible residency in the United States through investment. Recognizing the eligibility requirements and financial investment demands is essential for prospective applicants. This overview gives a considerable summary, including understandings on local facilities versus direct investments. As capitalists navigate this complex procedure, they need to also take into consideration the work creation needs and the advantages that accompany the EB5 visa. What aspects will eventually affect their choice?Understanding the EB5 Visa Program

While many immigration alternatives exist for people looking for to relocate to the United States, the EB5 Visa Program stands out as a distinct path for investors. Developed to stimulate the united state economic climate, this program enables international nationals to acquire permanent residency by investing a minimum of $1 million, or $500,000 in targeted work locations. Financiers must develop or maintain a minimum of 10 full-time jobs for united state employees through their financial investment in a new commercial business. The EB5 Visa not only supplies a course to united state citizenship yet additionally provides financiers the chance to take part in different organization ventures. This program charms specifically to those looking to expand their properties while adding to the economic growth of the USA.Qualification Criteria for UK Citizens

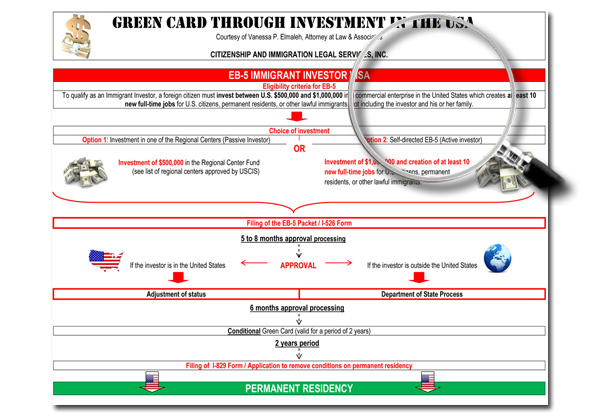

UK residents interested in the EB5 Visa Program must meet particular qualification standards to efficiently get long-term residency in the United States. To start with, candidates have to spend a minimum of $1 million in a new company, or $500,000 in a targeted employment area. In addition, the financial investment must maintain or develop at least 10 permanent work for united state workers within two years. Additionally, applicants need to demonstrate that their mutual fund are legitimately obtained, giving documents such as bank statements and income tax return. It is vital for people to maintain an active duty in the business, whether through management or policy formulation. Candidates must satisfy basic admissibility requirements, guaranteeing they do not pose any kind of safety and security or public charge threats to the United stateThe Financial Investment Process Explained

Guiding the investment procedure for the EB5 Visa entails numerous key steps that must be meticulously followed to guarantee compliance with U.S. migration laws. Capitalists need to choose between direct investment or involvement in a marked local. Next, they need to prepare the required paperwork, including evidence of funds' legitimacy and an in-depth company strategy that shows how the financial investment will produce the called for work. After picking a proper investment chance, the capitalist needs to transfer the funding, which is commonly a minimum of $1 million, or $500,000 in targeted work locations. Filing Kind I-526 with the U.S. Citizenship and Migration Solutions is important to start the application procedure and protect the potential for permanent residency.Regional Centers vs. Direct Financial investment

When taking into consideration the EB5 visa, UK residents face a choice in between spending with regional facilities or selecting direct investment. Each choice features distinctive investment structures, differing job creation demands, and differing degrees of danger assessment - Investor Visa. Comprehending these distinctions is crucial for making an educated choice that aligns with individual investment goalsInvestment Framework Distinctions

While both Regional Centers and Direct Financial investment represent paths for getting an EB5 visa, they differ substantially in framework and requirements. Regional Centers are companies assigned by the United States Citizenship and Immigration Provider (USCIS) that pool investments from multiple capitalists right into larger projects. This structure enables an extra varied danger and commonly involves much less direct monitoring from the capitalist. Alternatively, Direct Financial investment calls for a capitalist to position their funds right into a specific service and take an active role in its administration (EB-5 Visa UK Nationals). This direct strategy frequently demands more hands-on participation and an extensive understanding of business landscape. Each option provides unique obstacles and benefits, affecting the capitalist's decision based on individual preferences and financial investment objectivesTask Creation Needs

Task creation requirements are an essential element of the EB5 visa procedure, differing noticeably in between Regional Centers and Direct Financial investment options. Regional Centers focus on task development indirectly, allowing capitalists to count work produced through financial task stimulated by their financial investments. A minimum of 10 tasks should be produced or preserved per capitalist, commonly attained with larger, pooled financial investments in tasks like property growths. Alternatively, Direct Financial investment mandates that capitalists directly develop a minimum of 10 permanent tasks within their very own organizations. This technique may call for a lot more energetic monitoring and oversight by the capitalist. Understanding these distinctions is crucial for potential EB5 candidates, as the chosen course greatly influences their capacity to satisfy the program's work development needs.Danger Evaluation Considerations

Exactly how do threat elements vary between Regional Centers and Direct Investment choices in the EB5 visa program? Regional Centers generally supply a varied investment technique, pooling funds from numerous capitalists right into bigger projects, which can alleviate specific risk. The success of these centers relies on their management and job selection, presenting potential pitfalls if improperly managed. On The Other Hand, Direct Investment allows investors to keep higher control over their funds by investing straight in a service. While this alternative might provide a more clear understanding of financial investment operations, it also lugs greater threats because of the individual service's efficiency and market volatility. Eventually, financiers ought to consider the advantages of control versus the integral dangers of straight involvement versus the collective safety and security of Regional Centers.Task Development Requirements

A vital element of the EB5 visa program involves meeting particular work production requirements, which are vital for making sure the effective combination of foreign financiers into the united state economic climate. To qualify, an EB5 investor have to develop or maintain at the very least 10 permanent work for united state workers within two years of their investment. These jobs must be straight, indicating they are created straight by the company in which the capitalist has actually spent. Additionally, if investing in a targeted work location (TEA), the investor may additionally be eligible via indirect task creation, which is computed based on economic impact. Fulfilling these job creation requirements not only profits the investor but also contributes favorably to neighborhood areas and the general united state workforce.Advantages of the EB5 Visa

The EB5 visa program provides countless advantages for investors looking for a pathway to long-term residency in the United States. One of the primary benefits is the possibility to obtain visa for the capitalist, their spouse, and unmarried children under 21. This visa provides a distinct route to live, function, and research study in the U.S. In Addition, the EB5 program enables financiers to diversify their properties while adding to the united state economy via task creation. Unlike several other visa groups, the EB5 visa does not require a details organization background or supervisory experience, making it obtainable to a larger audience. Furthermore, it supplies a pathway to citizenship after fulfilling residency needs, which enhances long-lasting security and security for family members.Usual Difficulties and Considerations

Regularly Asked Inquiries

How much time Does the EB5 Visa Process Generally Take?

The EB5 visa see page procedure typically takes in between 12 to 24 months. Elements influencing the timeline consist of application efficiency, USCIS processing times, and prospective delays from regional centers or extra paperwork requests.Can I Include My Household in My EB5 Visa?

Yes, an applicant can include their instant member of the family in the EB5 visa. This typically encompasses a partner and unmarried kids under the age of 21, permitting for family unity during the migration process.What Happens if the Financial Investment Stops working?

Are There Any Age Limitations for EB5 Capitalists?

There are no certain age constraints for EB5 investors. Both minors and adults can get involved, yet minors need a guardian to handle their investment. Proper lawful support is recommended to browse the complexities included.

Can I Operate In the U.S. While My Application Is Pending?

While an EB-5 is pending, individuals can not work in the U.S. unless they hold a legitimate job visa. Approval of the EB-5 grants eligibility for work without extra work consent.Capitalists should create or maintain at least 10 full-time tasks for United state employees with their investment in a new industrial business. Regional Centers concentrate on work development indirectly, permitting capitalists to count jobs produced with financial activity boosted by their investments. EB5 Visa. A minimum of 10 tasks should be produced or protected per investor, commonly achieved via larger, pooled financial investments in tasks like actual estate growths. On The Other Hand, Direct Financial investment mandates that capitalists straight produce at least ten permanent work within their own services. To certify, an EB5 capitalist must create or maintain at least ten full-time jobs for United state employees within two years of their investment

Report this wiki page